The U.S. has seen a huge rise in inflation rates in the past year, most prominently as a result of the economic impacts of the COVID-19 pandemic. Trillions of newly printed dollars have been injected into economies around the world, including the United States. While this is a good temporary fix to the shrinking economy, there are potentially massive downsides to this hyper-injection of currency.

If you live in a country that is beginning to show signs of hyperinflation, it’s important to hedge your money to ensure that it retains, and ideally gains, value. Not bound by borders or tied to any country’s currency, Bitcoin is a great hedge against inflation. Purchasing or mining Bitcoin will result in owning a currency that does not depreciate in value, offering relief in light of such economic impacts.

Inflation and Hyperinflation

Inflation is measured by central banks by calculating the rise in the average price of a basket of goods and services. The rate of inflation can rise for numerous reasons, but it ultimately relies on a greater demand for goods and services, or the devaluation of currency through the introduction of more money into the economy by central banks, as explained in a recent report by longtime crypto exchange operator Kraken, titled Inflation: The Insidious Thief. When the money supply is increased by central banks, it causes greater demand for goods and services which can cause a spike in price.

Hyperinflation occurs when a central bank injects too much money into the economy too quickly, causing prices to rise upwards of +50% per month. The most recent case of hyperinflation was in Venezuela, where the monthly inflation rate increased by nearly 350,000% in February of 2019.

Effects of Inflation on the Government and Banks

High levels of inflation create unstable environments for not just consumers, but also banks, governments, and the economy as a whole, directly affecting participants in the global economy.

With consumers struggling to get by, they tend to pull more of their money out of banks and deposit less. This limits a bank’s ability to loan money, resulting in higher interest rates and less operating power over time. While inflation rises and the interest rates for a bank’s active loans must remain the same, this means the bank is receiving less value for their gained interest.

With citizens losing trust in institutions such as banks due to imposed sanctions, inflation rates, and exchange rate policies, Bitcoin brings economic empowerment and can fuel economic growth independently from fiat currency. Bitcoin has a different set of rules and a different trajectory than the U.S. dollar or any other country’s currency, providing an effective hedge against the inflation of any national currency.

As production and spending decrease due to rising prices, the government sees a decline in tax revenue, forcing them to cut costs and run at a deficit. As the government continues to run at a deficit, more money is often released into the economy which further increases inflation. El Salvador, following an economic crisis, adopted the U.S. dollar in 2001. This made them susceptible to U.S. imposed economic systems and sanctions, which has had a negative effect on the region. They have since passed legislation that could potentially make them the first country to make Bitcoin legal tender. This plan aims to create jobs and provide financial inclusion to the many citizens in the country who don’t have access to formal bank accounts.

The effects of inflation on government are no modern development, with powerful institutions such as the Ottoman Empire facing the economic repercussions of inflation that resulted in frail traditional industries, and the eventual demise of the empire itself. Such moments throughout history act as an ongoing reminder of the significant influence currency debasement can have on global economies, no matter how strong and stable they may seem.

Effects of Inflation on the Consumer

Inflation can have multiple negative effects on consumers, beginning with a large decline in purchasing power. Those affected the most are consumers with a lower socioeconomic status who keep most of their savings in cash.

As purchasing power falls, the value of this fiat currency also declines. Those who invest money in scarce assets such as Bitcoin and real estate can see a large gain as the demand for these commodities rises; Bitcoin’s reputation as a significant player in economic empowerment continues to stem from its real-world usability as it blends into traditional fields of assets and investments, including real estate.

How You can Protect Yourself from Hyperinflation

As prices rise and the value of fiat currency depreciates, you need a solution to protect yourself and your assets. This can be done by securing your money in investments that appreciate with inflation. There are several options including gold, real estate, and Bitcoin. These assets are not dependent on the price of common goods and services, and are not directly affected by the government injecting more money into the economy.

Gold has been used throughout history as a hedge against inflation because of its price stability, scarcity, and fungibility. But with advancements in technology and a growing interest in the decentralization of currency, Bitcoin seems to be a growing choice for investors as a hedge against inflation. Contrary to popular belief, it also has a lower environmental impact than the gold mining industry.

Sometimes referred to as digital gold, Bitcoin’s computer code ensures that it has similar properties to the precious metal. It is scarce, supply inflation-resistant, highly fungible (just like gold), and it is also fully decentralized. One potential issue with gold is that there are methods of purchasing it that are not fully guaranteed, such as paper gold and ETFs. Unless you physically own the metal at home or in a storage location, your gold is not 100% guaranteed to be yours. The decentralization of Bitcoin on a blockchain ensures that it belongs to you and cannot be stolen, misplaced, or tampered with.

Follow the “Smart Money” to Bitcoin

Many billionaires, among others, have been purchasing large amounts of Bitcoin in the past year as a hedge against potential inflation. This “smart money” league includes investor Paul Tudor Jones, Microstrategy’s Michael Saylor, and Tesla’s Elon Musk. These investors are helping to solidify Bitcoin as a legitimate inflation hedge by publicly placing their confidence in the cryptocurrency.

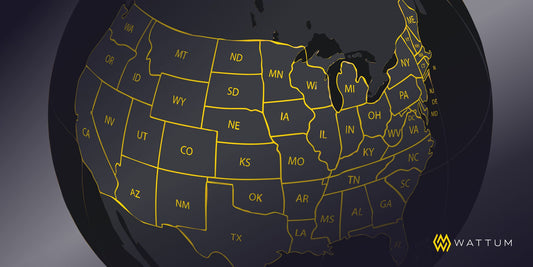

While buying cryptocurrency is a great option, there is another huge opportunity on the rise. The crackdown on bitcoin mining in China has caused a major drop in global hashrate, making Bitcoin mining much more profitable than it was just a few months ago. With displaced Bitcoin miners moving out of China and looking for new accommodations, Wattum is already set up in Kazakhstan, a great hosting location that offers competitive prices and a crypto-friendly government.

With the “smart money” going into Bitcoin for the long term, Bitcoin mining solutions could be the hedge against inflation you are looking for. Contact Wattum about our mining management solutions today and secure your investment before inflation worsens.