It is long-standing public knowledge that billionaires like Elon Musk and Warren Buffett have been able to minimize their federal income taxes by employing advanced tax management strategies. Despite the tremendous amount of wealth they accumulate annually, these maneuvers allow them to pay a minuscule tax percentage. However, these methods of minimizing taxes are no longer restricted to the global elite. Cryptocurrency offers an opportunity for everyday citizens to legally decrease their taxable income based on current regulations, while still increasing their accumulated wealth.

How do the Billionaires do it?

Income taxes are built upon the notion that the individual must reap proceeds from the sale of an asset before it can be taxed. Therefore, if an individual has not sold anything, nor ‘realized’ any gains, they cannot be taxed. This builds the foundation for navigating the taxation system to minimize the amount of taxes you pay yearly, a method often exploited by the wealthy. A recent court case in Texas regarding the mining and staking of crypto is expected to make Bitcoin mining even more attractive, highlighting it as a strong investment. If the judge rules in favour of the couple’s claim, coins earned from mining will be non-taxable until sold for financial gain.

A favourable ruling would reinforce the potential of cryptocurrency mining investments to minimize taxable income, putting a tried-and-true wealth management strategy into the hands of the everyday investor. On the heels of this major opportunity, Wattum is working to help customers towards financial empowerment with expert knowledge and mining opportunities.

From 2014 to 2018, Elon Musk paid a true tax rate of 3.27%. Going even further, Warren Buffett paid a true tax rate of just 0.10% during the same time period. Buffett is widely known as one of the most successful investors of all time, and is one of the richest men in the world. These men are able to minimize their reported income by not actually ‘realizing’ a high value of their gains as income, while their wealth continues to compound. This is partly because they accumulate wealth through their investments as they increase in value but don't often sell these shares, so no gain has been recorded to be taxed. They then take out sizable loans from banks for personal expenditure to avoid cashing out these stocks. This is how the rich stay rich.

Changing the Tax Landscape

The Biden Administration recently revealed a variety of planned tax hikes for the wealthy in the U.S., nearly doubling the rate of capital gains tax for high-earners. The revenue earned from these tax hikes will be allocated toward Biden’s American Families Plan. However, Bitcoin mining value earned is taxed as income once sold, rather than capital gains, commanding a lower tax rate.

Another reported change is a proposed corporate tax rate increase from 21% to 28%. The U.S. is pushing for a global corporate tax minimum to reduce the likelihood of companies’ headquarters leaving the U.S. for these ‘tax havens’. A meeting between the G7 revealed a global tax agreement that will change the international business landscape, announcing that corporations should pay at least 15% in corporate taxes. This historic agreement between the US, UK, Canada, France, Germany, Italy, and Japan will drop the hammer on corporate giants like Google and Amazon that move their international headquarters into different countries with lower corporate tax rates.

Ireland reaps benefits from offering a low tax rate of 12.5%, hosting the European Headquarters for many pharmaceutical and tech companies. This disparity in tax rates pulls companies away from the home countries in which they also operate, increasing tensions as tax revenue is taken away. This deal would force companies to pay the minimum tax rate of 15% regardless of where they are based, stopping corporations from seeking out ‘tax havens’. However, the deal still needs to be passed through the G20, which includes other countries with developing economies.

How can Everyday Citizens Capitalize on this?

Bitcoin mining can help minimize the amount you are paying in taxes each year. Bitcoin earned through mining as opposed to being purchased on the market is taxed as income rather than capital gains. Mining equipment is also depreciable on tax returns because it utilizes computer hardware, which has a 100% depreciation allowance for purchases on computer property after September 2017. The passing of this bill may be the trigger needed to push mining to guide Bitcoin prices to their next anticipated milestone: $100,000 per coin.

By holding your mined Bitcoin in a secure wallet, your wealth will appreciate as the value of the coin increases, and yet it won't be taxed until you sell it. This employs the same strategies used by the likes of Buffett and Musk to minimize their yearly taxes.

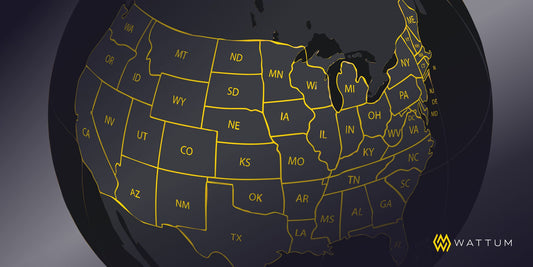

To set yourself up for success as you foray into crypto mining, you need a trusted partner experienced in mining and management. Wattum is committed to helping you maximize your mining revenues while minimizing the taxes you need to pay. We sell mining equipment, firmware, and provide hosting, management, and mining pool services. Experienced in maximizing profitability for our customers, Wattum offers high hashrate miners, low hosting prices, and competitive return on investment timelines. Imitate Musk and Buffett’s tax planning strategies: partner with Wattum to launch your Bitcoin mining venture today.