As Bitcoin prices surge and acceptance of the digital coin becomes more widespread, a multi-year rally seems increasingly likely. With Bitcoin's emergence into the mainstream, cryptocurrency mining is drawing comparisons to another income-generating asset: real estate.

Just as traditional stores of value like gold are needing to make room as Bitcoin moves in, the common investment practice of real estate is one asset that may soon find itself competing with Bitcoin mining operations for investment dollars.

Start Getting a Higher Return on your Investment

The notion of investing in Bitcoin mining may prompt feelings of uncertainty for some, but look closer and there are some striking similarities between this investment and traditional real estate. Both are undeniably assets that can appreciate as their respective markets grow hot, often selling for the same as or more than what they were purchased for. And while both carry the potential for needing repairs, requiring an annual repair reserve at about 1-3% of their market price, both can also be insured. Property insurance is a common resource across a majority of homes in the United States; interestingly, Bitcoin mining equipment can also be insured through programs such as Wattum Care, a pioneering program which will be launching within the next few months.

While real estate remains a popular investment, it can quickly get complicated when taking into account additional expenses such as property taxes, lack of mobility, and its lack of depreciation ability on tax returns unless it is in an opportunity zone. Mining hardware, on the other hand, can be depreciated for its full sum in the first year or over 5 years and is mobile, offering flexibility in terms of not only where you mine, but how you mine.

Another factor is the reliance of real estate investors on rental incomes, which in itself can pose a cost risk in terms of preparing a home for tenants, as well as finding suitable tenants that will take care of the property and avoid further expenses. Further, the average annual return on investment (ROI) for rentals falls between 8% and 15%, whereas typical ROI from Bitcoin mining ranges from 20% to 100%. With the Biden administration’s proposed capital gains tax hike anticipated to increase annual tax rates to as much as 48% for those earning more than $1 million, real estate investments are hard pressed to remain the most profitable and secure solution.

A New Opportunity for Flexible and Secure Investments

Trusted for centuries as a vehicle for investment, land ownership is perceived by many to be highly secure, yet the real estate market has had its fair share of ups and downs. These fluctuations can be particularly problematic for purely speculative real estate investors. Bitcoin mining is safe from these waves as a regular stream of Bitcoin is produced regardless of its market price. Although rental income can be converted into Bitcoin almost instantly, many are unaware of this opportunity and thus miss out on its benefits. Should the prospect of investing in both real estate and Bitcoin mining interest you, the option of acquiring property and converting it into a Bitcoin mining colocation center is possible with data center building experts such as Colobuilders.

Bitcoin mining equipment is both relatively safe and potentially lucrative, projecting a sizable return while maximizing potential profits. Purchasing a miner, typically priced at less than $10,000, sets you up to mine Bitcoin for years to come. Locking in mining equipment at current day prices projects even faster returns, should the price of Bitcoin continue to rise, and if the current shortage is any indication, the reported spike in equipment demand will persist well into the new year.

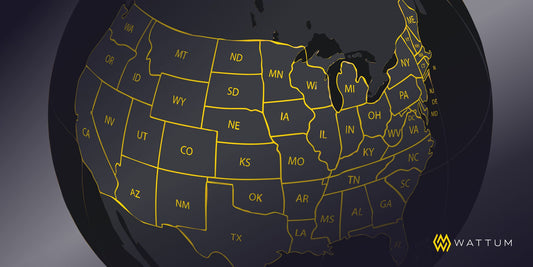

As a reputable equipment reseller, Wattum has taken proactive steps to ensure a high availability of stock for both new and used mining rigs, with numerous shipments still set to arrive in the coming months, including the widely acclaimed Antminer S19j. Wattum’s team of experts is qualified to deliver management and hosting services across 6 facilities in North America and around the world, and offers mining pool opportunities for individual investors and mining farms alike. Through partner firm Colobuilders, Wattum retains over 35 years of data center design and building experience to enable clients with bigger dreams to outfit their own mining facilities and colocation centers.