It’s a famous question that has transformed thought and choice in ways that exceed the parameters of a famous 1999 cinematographic masterpiece: to live in blissful ignorance, or to accept the gift (and curse) of awareness in an ever-changing reality?

Red pill, blue pill - or orange pill? Some would argue that Bitcoin has provided a third choice that combines the two countering experiences and creates a balance between the more respectable qualities of each. Bitcoin is transforming reality through its influence in everyday life, seeing a surge of innovation in digital payment as well as clean energy and environmental protection, among others. However, not everyone agrees.

Why Bitcoin?

Many who have entered the world of Bitcoin can attribute their experience to a mix of sheer luck and risk tolerance. Taking calculated risk boils down to one of the scarcest assets known to humankind: time.

Time is as scarce as Bitcoin, with one caveat: there’s no way to store time. If you traded your time for some sweet sats (or Satoshis, the smallest unit of Bitcoin) they could be stored in perpetuity in order to leave behind a legacy of generational wealth, inherently incorruptible and leaving you with the confidence that it will not be devalued.

Despite the life changing opportunities offered by Bitcoin, doubt still circulates on the side of crypto skeptics that Bitcoin is a scam, or a Ponzi scheme, that Bitcoin mining is destroying the environment. Only criminals use Bitcoin. Bitcoin is the same as gambling. If you recall, Warren Buffet himself notably referred to Bitcoin as rat poison, squared. Jamie Dimon joined in to call Bitcoin a scam and yet, in 2021, JPMorgan is offering their wealthiest clients access to Bitcoin.

Instagram | Twitter

In the present landscape, it is fascinating to see experts of old tech commenting on a new paradigm that has played a role in making their paradigm obsolete. (Don’t be that guy).

Paul Krugman once confidently stated that, by 2005, the internet would have no greater impact on the global economy than the fax machine. This is the same man who has since emphasized that Bitcoin was a bubble at $1, at $10, at $100 - you get the idea.

This article is not meant to depict expertise in either finance or cryptocurrency, but rather aims to demonstrate a view on Bitcoin from the shoes of a beginner, so as to show how hope and Bitcoin may go hand in hand. Many of those involved with Bitcoin have stored all of the value that they have managed to accumulate in their lives in Bitcoin, but if anyone asks, it’s safe to say that trying to make sense of the new paradigm through the lens of the old is as effective and reliable as asking a carpenter to replace a car engine. A carpenter and a mechanic are both experts in their field, and provide a pretty digestible argument for the fact that just because you’re an expert in something, it doesn’t mean you should be commenting on everything.

The Everyday Miner

Let’s take a look at how an everyday Bitcoin miner views Bitcoin. It’s important to note the use of the term “Bitcoin” rather than “crypto”; the majority of the crypto industry is far more akin to the financial system compared to Bitcoin, which falls under a category of its own.

Many so-called experts within crypto would disagree, claiming that Bitcoin is outdated, slow, and expensive to transact, that other cryptocurrencies such as Doge, XRP and IOTA can process more transactions faster and cheaper than Bitcoin does. Right.

To avoid sounding like Bitcoin maximalists, let’s emphasize that, as members of this industry, a love for crypto in general is present. However, Bitcoin’s decentralized nature and key components that are set in stone code, along with the lack of a central entity changing the rules on a whim without consulting the consensus of the majority, are hardly insignificant factors that can be overlooked.

What does the Average Joe get out of Bitcoin?

Digital gold. The magical internet money. What can Bitcoin do for the everyday citizen?

For many enthusiasts, Bitcoin is a superior form of money due to the fact that it does not rely on a central authority, or “middleman”, for issuance or transactions. Bitcoin is money that is rooted completely and unabatably in the second law of thermodynamics, transforming energy such as electricity and labour into a fixed, incorruptible unit. It is an immutable network governed and enforced by hundreds of thousands of nodes and miners around the world. Simultaneously and consensually.

A unique constituent of Bitcoin is that it is entirely voluntary: a set of rules without a ruler that anyone can participate in, enforced at the level of the individual with nothing more needed than an internet connection. So, what would cause Bitcoin to be considered the perfect form of money? Is it the fact that it still embodies the qualities of physical money? Divisibility, mobility, scarcity, cognizability. Blue pill, red pill, orange pill.

Bitcoin is a perfect store of value. You can mathematically prove how much BTC you have in relation to the entire amount that will ever exist (21 million) and know that it cannot be diluted or altered as Bitcoin itself cannot make more Bitcoin. It all boils down to trust: if you buy stock, the company that you buy from can issue more stock and therefore dilute your investment. When you store dollars, the government can print more and dilute what you have. In other words, the percentage of Bitcoin that you own in relation to the entire supply of 21 million is fixed and verifiable in an openly distributed ledger, at all times.

Bitcoin can also measure all other goods and services as it is infinitely divisible. This means it can be divided into as small a piece as desired or needed, making it tradeable in practical quantities. As the purchasing power of Bitcoin increases, we can continue to divide it into smaller pieces to measure even smaller goods.

Acting as a medium of exchange, Bitcoin can allow you to send the exact amount you want, to whomever you want, whenever you want.

In his Youtube series, Hidden Secrets of Money, Mike Maloney illustrates that “money is a form of technology that only sentient species use to transmit information and value relating to energy, time and matter.” Bitcoin ideally embodies the characteristics of physical, traditional money.

How did Bitcoin Gain Traction so Quickly?

While we can agree with Warren Buffet on the point that many of those interested in crypto participate in blind gambling, there are those that understand Bitcoin’s raison dêtre and are attracted to it with a deeper rationale. The traditional financial system is thermodynamically fraudulent, designed to support and enrich the few in power while overlooking and inherently hindering the majority of the population. This is where Bitcoin steps in, with opportunities for true financial empowerment and independence.

While inflation and volatility of the US dollar is not something that is immediately felt or experienced, it does spread out across 5 to 10 years and hits just as hard, as exemplified by housing prices just 3 years ago compared to today.

Using this example of housing prices, it is clearly demonstrated how your dollar is less powerful today while the power and value of Bitcoin has only gone up). Recognizing inflation as a slow and steady predator will open your eyes to a decade-long pattern, further contributing to your understanding of the value of Bitcoin, and the value of non-dilution. Non-dilution refers to a type of financing where there is no loss, or dilution, of ownership.

For many, Bitcoin is a direct representation of hope. Transparency for all participants. It provides a way to fairly distribute wealth in accordance with economic contribution. There has been a fair share of fear, uncertainty, and doubt claiming that Bitcoin’s distribution is centralized to a handful of large whale wallets. This is swiftly debunked by taking a look at the on-chain data below, provided by analytics and blockchain data company Glassnode.

In fact, smaller entities that hold up to 50 BTC each (the shrimps, crabs and octopi) control almost 23% of the total supply. This demonstrates and supports that a substantial amount of Bitcoin is in the hands of retail investors, with an apparent upward trend across Bitcoin’s lifetime.

Bitcoin as Money

Money fundamentally measures and quantifies three things: time, resources, and energy. Sound money is defined as “money that is not prone to sudden appreciation or depreciation in purchasing power over the long term.”

Time, resources, and energy are three fixed quantities that cannot be produced out of thin air. Participants in a closed economic system perform, work and, depending on the subjective value of their product or service, trade this labour for money. This money can be saved for future transactions or used today. Work, in this sense, is produced as a result of energy and time.

For money to properly function and accurately measure products of labour, it must represent the aforementioned fixed quantities as closely as possible. This ultimately means that it should be a fixed quantity that cannot be altered by the whim of an authoritative entity. Changing the quantity of money essentially changes the units that money represents for a specific product or service. In theory, if you paid someone $50 today to fix your lightbulb, you should pay them the same price to carry out the same service next year, given that the demand for changing a lightbulb remains the same. This is what gives labour its subjective value.

The current financial system equates money to wealth. The problem is, “money” keeps being inflated. Without an equivalent increase in productive output or capital, we have much more money chasing the same output and capital, thus diluting the purchasing power of everyone’s money.

Between 2000 and 2021, it was not necessarily the price of building a house that increased, but rather the price of the land. In every decade since 1960, we have seen a continuous trend in the increase of tuition, minimum wage, the average family income, and so on. The separation of money and wealth is evident here - an increase in minimum wage is simultaneous with an increase in some of the highest wages and salaries in the country.

Despite these increases in minimum wage and family incomes over the years, the gap between salaries and real estate prices continues to grow wider, meaning some citizens will still need to work harder to catch up. Should a family income of $100,000 increase by 25% to reach $125,000, a home price of $500,000 will increase by the same percentage to reach a whopping $625,000. Looking at the dollar value, American citizens would have to work for a few extra years to afford the same house they could have purchased the year before.

The policy of unlimited printing impoverishes anyone who is prudent enough to work hard and save diligently, and gives anyone who holds any form of hard or tangible assets the illusion that they’re making more money over time, while actually not producing any additional value from these assets at all. To quickly revert back to Warren Buffet, “We’ve got the right to print our own money so our credit is good.” Ben Bernanke offers a similar nod, outlining how the 2008 bank bailouts were paid not from taxpayer’s money, but with printed money.

All of the dollars that were printed in 2020 made up 21% of the total supply. While this may not sound significant, it has already started a hyper inflationary trend that will be realized on an annual basis. The early stages may be slow, but will suddenly jump over the next 5 to 10 years.

Many of those who partake in Bitcoin have never been wealthy, nor has their family ever had generational assets. Saving money has always been viewed as a cornerstone of the journey to financial independence, a life goal of having something to pass down to the next generation. When you disincentivize the concept of savings, by devaluing the means by which you store your assets, you begin to break the foundation upon which people as individuals build for their futures. This creates the potential for severe consequences, and is a fundamental reason for why those who understand Bitcoin are deeply attracted to it (not crypto).

Invest in Bitcoin?

It’s not as simple as you’d think to invest in a form of money that is viewed as superior, and that operates on a superior (and very technical) basis.

In the same way that anyone who holds the Zimbabwean dollar or Venezualan bolívar doesn’t “invest” in USD, but flees to it as a superior money that has a better guarantee of storing their economic value, people who understand Bitcoin are moving away from traditional, government-issued currencies. Instead, a migration to superior money, as assurance that their hard earned coin doesn’t wither away, is taking place.

There is no doubt that the world is changing. Faith and trust can now play a significant role in the circulation of traditional fiat currencies, and trust is mobile. Many are choosing to place theirs in the immutable laws of mathematics and physics before they place it in the promise of a bureaucrat. They trust, and they verify.

Bitcoin Mining

Mining is the name given to the validation process on the Bitcoin network used to both validate transactions and, in a broader sense, thermodynamically secure the network. To learn more about the fundamentals of mining, this article offers an extensive outline of the entire process and its history. Mining is how new Bitcoin is issued, until the maximum supply of 21 million coins is eventually reached.

The idea behind Bitcoin mining’s decentralization is that anyone can do it, you just need access to electricity, the internet, and a computer. In reality, a powerful, more specialized computer and electricity that’s cheaper than your average residential rate is needed to produce a meaningful amount of Bitcoin, but this is part of what gives Bitcoin value. The network is built on “proof of work”, and the output commensurates with the input. There’s a profit margin.

You cannot fake “work”, but need to actually spend valuable capital resources in order to get your hands on Bitcoin. It thermodynamically proves that, in order for a Bitcoin to be produced, a significant amount of “work” needs to be done. This can be likened to the concept of work in gold mining, which adds to the value of the mined gold. The resources and work put into mining are the proof that value was created.

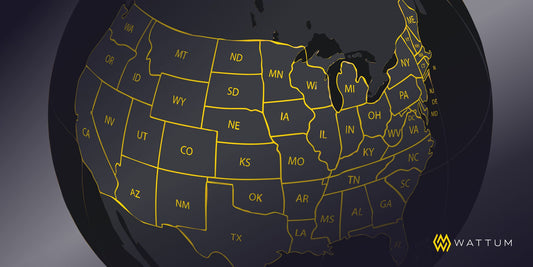

Despite decentralization, Bitcoin mining is no longer as accessible for the average person as it was just a few years ago. Back in the early days of Bitcoin, 50 coins could be mined every 10 minutes with the help of nothing more than your old laptop. For a deep dive into the hardware components of this “digital” financial revolution, this article breaks down everything you need to know about mining equipment and how to get started today. At Wattum, we provide end-to-end solutions for our clients to ensure success and growth in their mining operations, every step of the way. We offer a full suite of services that account for all of the tools and industry expertise you need. From hosting, management, and high-quality mining equipment, to discounted access to one of the world’s largest mining pools, and even buildout and design services that give passionate miners the opportunity to construct their own leading crypto mining farm with the help of over 30 years of experience across our knowledgeable team, Wattum is your partner in success from day one.

Why is Bitcoin Valuable?

Well, for starters, for all of the reasons mentioned above.

Thier’s Law states that good money pushes out bad money. Logically, anyone would spend money deemed inferior and try to save the other stuff. As more people come to understand what money really is, along with the discovery that Bitcoin is more than good money and is borderline perfect, they too will feel the desire to protect their wealth and measure the product of their labour in Bitcoin.

Assuming this process of discovery continues in the coming decades, we will see Bitcoin’s purchasing power continue to rise. In the early days of Bitcoin, its inventor Satoshi Nakomoto stated that, “as the number of users grows, the value per coin increases. It has the potential for a positive feedback loop; as users increase, the value goes up, which could attract more users to take advantage of the increasing value”.

We can think about this statement in a few different ways:

- Money is the biggest market of all. It represents and encompasses anything and everything.

- Bitcoin is perfect money. On a long enough timescale, everyone will realize this and begin using it due to the reasons discussed above.

- Bitcoin can not only represent everything there is, but every product, service, and commodity that there ever will be.

Technically, the equation for the value of a single Bitcoin is infinity divided by 21 million. That is an infinity of times larger than today’s Bitcoin price of over $50,000, in October 2021.

Should I "Invest" in Bitcoin?

As mentioned earlier, the onus is on you to understand money first, and then Bitcoin. If there is a lack of understanding around money, the value proposition provided by Bitcoin is impossible to grasp properly. For a full understanding of Bitcoin as a subject, it is likely that hours of reading and research across fields of mathematics, physics, economics, praxeology, philosophy, anthropology, and even human evolution are in the cards. With respect to Darwin, it is not impossible.Such reading would cover the fundamentals of Bitcoin and Bitcoin mining, and yet it would still leave gaps pertaining to its technical side. You don’t have to be an expert, but once you’ve covered some ground on the philosophy and history of money, and once you understand Bitcoin’s reason for being, you won’t be asking if you should invest in Bitcoin. You will have found your Orange Pill moment.

So, What's the Catch?

It’s difficult to see a downside to Bitcoin once you truly grasp it as a concept, both theoretically and practically. The real downside to be wary of is the realization that you are still holding onto dollars deemed worthless, yet are being infinitely printed. From an evolutionary standpoint, Bitcoin will do to fiat money what gold did to all other weaker monies, including shells, rocks, and even the practice of bartering. However, Bitcoin will compress five centuries into a few decades thanks to the network effect brought about by the internet.

It’s difficult to see a downside to Bitcoin once you truly grasp it as a concept, both theoretically and practically. The real downside to be wary of is the realization that you are still holding onto dollars deemed worthless, yet are being infinitely printed. From an evolutionary standpoint, Bitcoin will do to fiat money what gold did to all other weaker monies, including shells, rocks, and even the practice of bartering. However, Bitcoin will compress five centuries into a few decades thanks to the network effect brought about by the internet.

While there is much talk around the negative aspects of Bitcoin’s energy consumption, it is naive to think that Bitcoin is either the first or the worst contender for energy use (especially when you consider that Bitcoin’s actual energy use can be equated to that of the toaster on your kitchen counter).

The traditional financial sector consumes a much greater magnitude of energy than Bitcoin, and yet Bitcoin can do the same job, but better and with the same rules applying to everyone.

Nothing is more important for the environment, the equality of economic opportunity, the transformation of the economic system, and the clean up of the financial system that impacts every citizen of the world than a collective move into Bitcoin.

To answer your question: yes, you will likely become very wealthy by participating in Bitcoin and Bitcoin mining, much like anyone who mined for gold early on and, holding onto it, saw their purchasing power go up.

More importantly, you will see an accomplishment of historical good and fulfillment of moral duty through the support of a move into better, sounder, and more fair money for future generations.

If that sounds good, it’s because it is. Claim your place in the financial revolution and support the Bitcoin network by participating in mining and increasing it’s security. It may sound like a lot of this information belongs to industry experts, but that’s because they’re simply better at explaining it; getting in touch with Wattum allows you to not only understand all of the fundamentals of Bitcoin and Bitcoin mining, but it makes it accessible. To start your own mining journey (and be good at it) contact our very own Bitcoin enthusiasts today. We’re passionate about equipment, hosting, data center construction, and even Darwinism. Having a resource that provides you with end-to-end solutions will put you one step ahead, whether you’re a seasoned miner or just entering the game. Choose the orange pill.