With the current temperature of the digital asset landscape fluctuating due to major global events, including the war on Ukraine, many have begun to question Bitcoin’s resilience on the global stage, and whether or not the future really is Bitcoin.

Despite Bitcoin starting the year off with a lower-than-desired price point of $46,000, dipping even lower in following months as a result of global events and resulting economic uncertainty, the BTC price has since managed to hold steady.

Bitcoin’s Upward Flow

The Bitcoin Stock to Flow Model is a visual representation of how many years it takes, at the current production rate, for current stocks to be achieved. In other words, it offers a snapshot of Bitcoin’s price fluctuation over the last decade.

The model, more importantly, shows how the price of Bitcoin has consistently bounced back over the years to hit a new high, as we excitedly saw in the latter half of 2021 when BTC jumped to $64,000 USD. The model also shows how BTC is starting nearly each year at a higher low. In 2021, Bitcoin started out at around $26,000 and then nearly tripled by December - all of a sudden $46,000 isn’t looking so bad.

Despite the price drop earlier this year, industry-leading hardware manufacturers such as Bitmain have continued to innovate, bringing new players to the Bitcoin mining table such as their newest Antminer S19 XP Hydro. The Antminer S19 XP Hydro, preceded by the Antminer S19 Pro+ Hydro, is the latest ASIC in Bitmain’s series of liquid-cooled miners, offering a higher hashrate and greater efficiency than the flagship S19 XP model.

What’s next for Bitcoin?

So, what can we expect from Bitcoin once these global events begin to settle? We’ve already seen it play a role in the aid and support of causes worldwide, a fact which was highly publicized and then followed by a BTC price recovery shortly thereafter. Is it finally time for Bitcoin to earn its stripes and garner true mass adoption as a result of this demonstrated use value?

In a live interview hosted in July of 2021, ARK Invest CEO Cathie Wood was joined by Twitter and Square CEO Jack Dorsey and Tesla Motors CEO Elon Musk to discuss “the ₿ Word”. The livestream was wrapped up with a final question: what is the future hope for Bitcoin, and how can it impact the world?

Of course, the Bitcoin landscape looks quite a bit different nearly one year later. As Bitcoin’s role on the global stage diversifies, there have been a significant number of developments pertaining to its global regulation, as well as a widespread recognition of the importance of access to payment technology around the world as Bitcoin demonstrates its use value in everyday life.

Discussing Bitcoin’s potential and the technology behind it during July’s livestream, ARK’s Cathie Wood considered Bitcoin in the context of macroeconomics and the monetary system, with her insights on how Bitcoin is viewed as an intangible asset (meaning if Bitcoin’s market value goes down, you need to mark it down in your books, but if it goes up you can’t mark it up) leaving room to draw a parallel to today’s regulatory landscape, where Bitcoin is concerned. In March 2022, President Joe Biden made digital asset history by signing an Executive Order outlining the “first ever, whole-of-government approach” to addressing digital assets and their potential benefits, demonstrating an acknowledgement of Bitcoin’s longevity on an administrative level.

Acceptance and Demand

The price of Bitcoin mining equipment is often closely correlated with the price of Bitcoin itself. However, despite Bitcoin’s price dip, demand for crypto mining equipment hasn’t slowed down, and as mentioned, industry leaders continue to innovate with new miners and technologies for improved mining performance. As the price recovers, this demand is expected to increase, boosting the price of mining hardware and making them harder to come by as miners buy up the available supply to scale their operations.

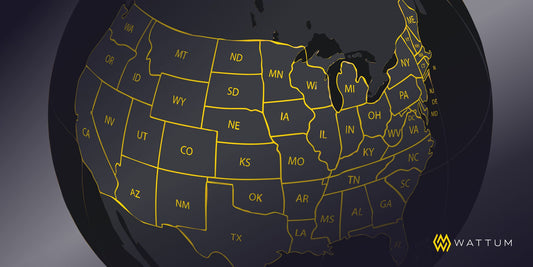

As Bitcoin mining migrates to the United States, escaping tighter regulatory grips on mining in Kazakhstan and Russia, scaling your mining operations isn’t limited to just buying more miners. Texas, for one, is exploring ways to share its energy grid with mining and hosting facilities, and Wattum’s Energy and Buildout departments have developed client growth strategies that allow miners to build out their own facilities, or purchase land and equip it with mobile mining containers. Because why stop there? While we may not be seeing a major spike in mining equipment demand just yet, we are seeing an expansion of mining opportunities and state-level acceptance that is helping to create a whole new mining experience going forward.

Will Bitcoin really reach $500,000?

The ₿ Word livestream was wrapped up by asking what the future hope for Bitcoin is, and how it can impact the world, if at all. Twitter and Square CEO Jack Dorsey answered simply: world peace.

While Bitcoin has played a significant role in enabling swift financial aid for various relief organizations as well as individual families during the Ukraine crisis, it also demonstrates its ability to improve upon our current ways of sending and receiving money - something members of the crypto community have been trying to drive home for some time now. As Elon Musk put it during the ₿ Word, “Money is an information system it’s important to look at something that improves the quality of the information.”

Both Dorsey and Musk personally hold Bitcoin, with Musk emphasizing that he holds more Bitcoin than he does Ethereum or even Dogecoin. The reason is probably obvious. Cathie Wood, as a disruptive innovator herself, has previously shared her predictions for Bitcoin’s growth rate, citing $500,000 as the milestone to watch out for.

Whether BTC hits $100,000, $200,000, or $500,000, ARK Invest, Tesla Motors, Square and Twitter all have different relationships with Bitcoin and digital assets as a whole, and it’s important to bring the conclusion back down to the individual miner, like yourself. As Bitcoin price trends (as indicated by the Bitcoin Stock to Flow Model) continue to point towards a prosperous future filled with higher lows in every new year, miners have a decision to make.

The Next Bitcoin Trend

With trends pointing towards an increase in BTC price, miners will want to avoid being left behind when the spike in demand makes hardware more difficult and more expensive to come by. Not only does the price of Bitcoin mining equipment correlate to rising Bitcoin prices, but talks of Ethereum’s transition to proof of stake are circulating once again, this time with a projected “Merge” date of Q3 2022.

Quick recap: if Ethereum transitions to PoS it will no longer need to be mined, and there will be no use for GPUs outside of gaming and the mining of alternative coins, which means GPUs go back into the hands of gamers while crypto miners dive head first into the ASIC market. In other words, ASIC demand spikes.

With all of this traffic around Bitcoin as of late, and no doubt more to come, the Wattum team can equip you with everything you need to not only keep up with the crypto market and mining trends, but to stay ahead.

From acquiring mining equipment and building out your own facility to hosting and management services, we’ve got the A-Z tools you need to grow your mining operations. Don’t be a Greg, get started today and beat the trends.